Charting a Roadmap in the Growing Cannabis Economy

The Cannabis Conversation is Getting Louder

April 20th is right around the corner, and that date (aka 420) has become a bit of a national holiday for cannabis culture. With that in mind, we released "Seven Surprising Cannabis Insights for Marketers", a "Green" paper that unveils some interesting insights into consumer behaviors and attitudes around Cannabis.

Whether it has the potential to disrupt the way your brand interacts with other brands and consumers, or it is just a passing distraction, the conversation about cannabis is happening now and there are still many unknowns about its implications. Not only do a majority of Americans support cannabis legalization, but a large portion would consider supporting cannabis-business opportunities.

To inform a smart, data-driven approach to the cannabis marketplace, MRI-Simmons has developed the first cannabis-focused syndicated research report – the 2018 MRI National Cannabis Study – to help get you up to speed on all-things cannabis related, gain insights on how it could impact your market, and make decisions on how to invest in the phenomena (if at all). The study provides a full spectrum of the cannabis market in the US, and with it, you’ll be able to:

- Track supporting/opposing opinions to legalization across the country

- Discover who the consumers are – what they consume, why they do or don’t, where they buy, and how the future of the market could take shape

- Utilize two sets of segmentations

- Six psychographic segments based on cannabis attitudes and perceptions of users and non-users

- Three behavioral segments based on user consumption trends

According to the study, 16% of Americans 18+ are cannabis consumers – that’s 38 million adults, and this number is only going up as more states take incremental steps towards full legalization. Understanding exactly how your brand/your consumers fits into this growing landscape, and how much opportunity might stem from it, is imperative to stay relevant and competitive.

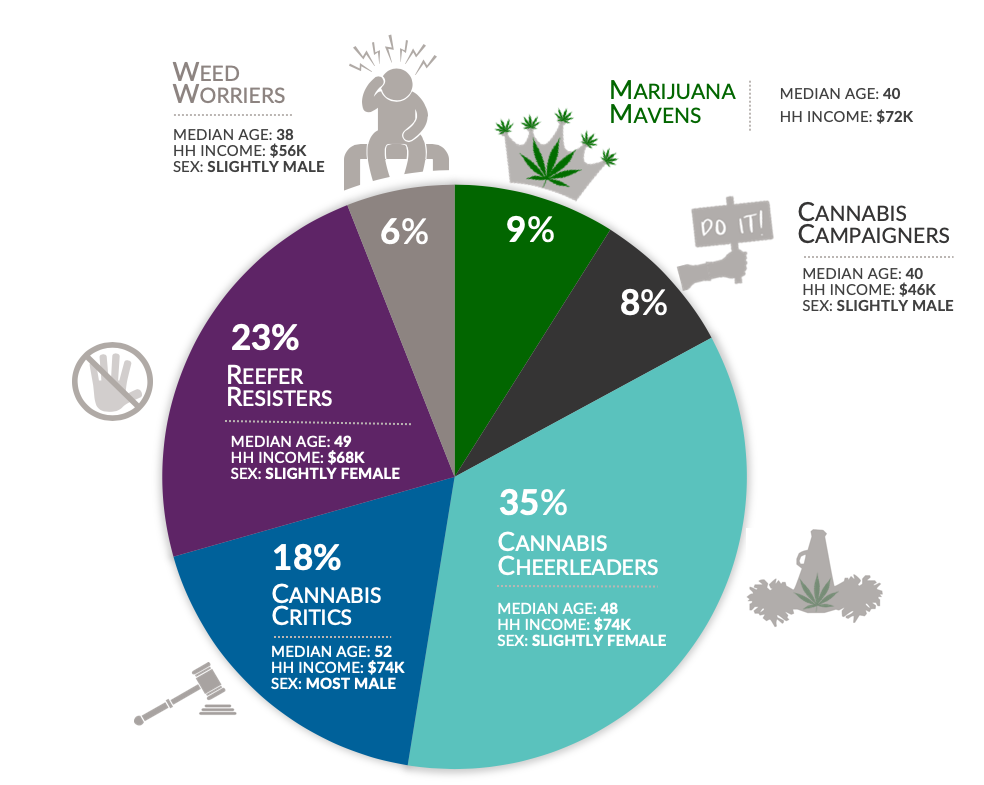

As with any topic, there are going to be both avid supporters and resistant naysayers. Our six cannabis attitudinal segments describe the full spectrum of the American population based on their shared opinions and consumption patterns of cannabis. These segments are based on a wide range of opinion statements that were grouped together into five “super attitudes” relating to cannabis legalization and use: Positive, Negative , Cautious, Proactive, and Informed.

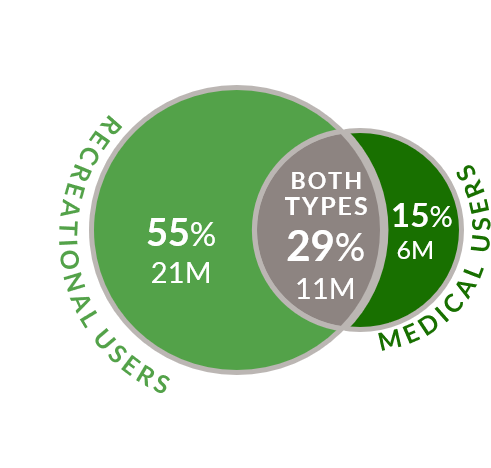

But what about actual cannabis consumption? A majority of the 38M consumers do so recreationally, some do so for medical reasons, and a handful do so for both reasons. To help explore consumption difference even further, we’ve created three more segmentations regarding cannabis consumption behaviors.

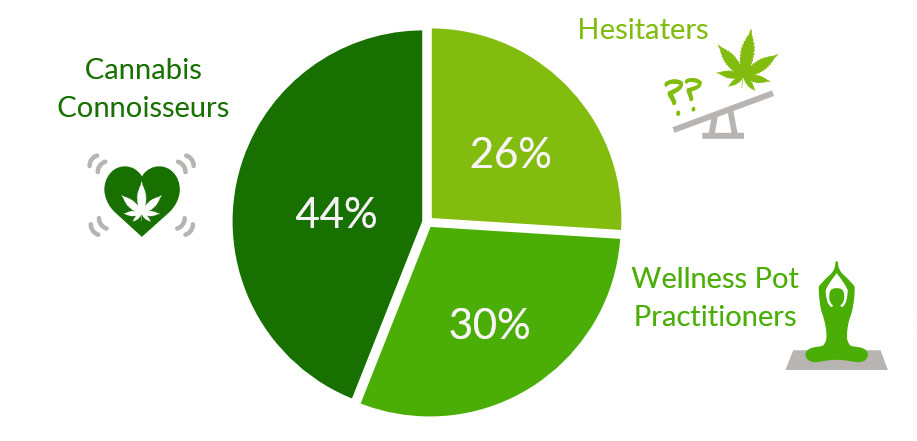

Not every cannabis consumer is the same – which is why we’ve taken the 38M people who consume and split them into three different segments based on how cannabis relates to their lifestyle. From these behavioral segments we can already see potential opportunity for cannabis to intertwine itself with other product categories and partnerships – another step towards figuring out if taking part in the trend is the right move for your brand.

Cannabis consumers may be known for satisfying their munchies, but over 80% of consumers say that their purchases while consuming don’t differ from purchases made while not consuming. In addition to food and entertainment, many consumers say they’ve purchased clothing and event tickets, revealing potential marketing and partnership ideas for selling to cannabis consumers. Another surprising insight – many consumers say they become inspired while consuming cannabis to make big ticket purchases later, from home improvement/décor items to motorcycles. Furthermore, cannabis users in general consider themselves “spenders” rather than “savers”, and they have a lot of interest in spending on a variety of cannabis-themed versions of products and services that already exist. Some have already been introduced into the market, like cannabis-infused beverages, while some are pending national legalization status, like cannabis-friendly hotels/resorts All demonstrate the valuable opportunity for cannabis penetration in the market.

Want even more insights on consumers and Cannabis? The complete 2018 MRI National Cannabis Study is now available for purchase as both a syndicated data set and a comprehensive report. The complete report provides a deeper exploration of Cannabis usage and attitudes, including:

- What is cannabis, and why does the study matter?

- Complete, detailed profiles of the cannabis attitudinal and consumer segments

- Purchase behavior analysis of current consumers

- A comprehensive use-case of how these insights are actionable

To learn more about the complete National Cannabis Study and Report, visit:

https://mrisimmons.com/solutions/focus-studies/national-cannabis-study/

To download our Cannabis "Green" Paper (Seven Surprising Cannabis Insights for Marketers), visit:

https://www.mrisimmons.com/reports/seven-surprising-cannabis-insights-marketers/

For further questions, contact:

Mike Panebianco, Vice President - East Coast Agency Sales

Michael.Panebianco@gfk.com

(212) 884-9238