Consumer spending: Uncertain times call for a new playbook

This guest post contributed by Travis Meeks, Vice President of Marketing for Analytics IQ

Understanding what a consumer can afford is not the same as what they choose to afford

We’ve all had that moment at some point in our lives. For some it was in college. For others, just last week. We’re eyeing a luxury, debating the value, and thinking “Can I afford it?” While many marketers and data analysts have used income as a barometer to analyze that moment in consumer behavior, we are realizing as an industry how incomplete a story income alone can tell.

It’s not as though income data isn’t incredibly valuable. In fact, household income is probably the go to data attribute most data-driven marketers rely on when analyzing an audience. It’s especially powerful in modeling, popping frequently as an influential attribute for companies across industries.

Income is great - it’s just not everything

Income has also been used as a tool to identify consumers that can afford certain products. High income individual? Clearly a great match for luxury products. Lower income consumer? Value priced brands may be the best fit.

Unfortunately, when economic uncertainty is introduced as a factor, some tried and true techniques, like segmentation by income, lose their dependability. When job insecurity and inflation come into play, consumers are evaluating more factors, making it a greater challenge for marketers attempting to meet their needs at the right moment, with the right message, and in the right place.

Updating your “affordability playbook”

The answer to “can I afford this?” isn’t as straightforward as it used to be. Consumers are evaluating additional factors as they weigh their options in the aisles. While some are broad, others are specific to the purchase being made:

- Necessity: If a purchase is deemed essential, they may prioritize that purchase, and defer or skip a luxury purchase they would have made. Medication, or essential food items like bread or milk often fall into those categories.

- Low cost: Once they have decided to buy within the category, how low of a price can they get while still meeting their needs? Selecting store or off brand items often fall into this category.

Consumers consider personal finances

Beyond the specific purchase being evaluated, consumers are also looking at their broader financial position.

- Job security: Do they work in an industry with a great deal of job security or have layoffs affected their peers?

- Existing debt: Recession concerns cause consumers that may have been otherwise unconcerned, to be more attentive to existing debt. Especially when combined with job insecurity, consumers may be less likely to take on additional debt.

- Savings: Even if a consumer has their debt under control, they may set steeper savings goals to give themselves more peace of mind. So, while someone may technically be able to afford a discretionary purchase, they may choose not to in order to save.

Life stage has a huge impact on a consumer’s approach to managing their finances:

- Mid-life: Consumers who are actively seeking opportunities to maximize their financial growth are, on average, 39 years old. They are entering their prime earning years but still have a runway ahead of them to drive growth.

- Planning for retirement: Those who are likely to be motivated to have a financial plan in place come in at just under 60 years old. As they near retirement, consumers become more receptive to guidance on how to plan for their golden years.

- Never too late: Individuals who are likely to be motivated to organize their finances are 74 years of age on average, indicating a desire to have all ducks in a row as they grow older.

Source: https://analytics-iq.com/six-key-trends-in-consumer-finance-shaping-marketing/

Consumers adjust their spend, but not all in the same way.

Obviously, there is still a lot of subjectivity to all of these factors, and what is deemed “necessary” or cheap enough will vary by consumer. This is true even if the consumers are within the same income bracket, have similar amounts of debt or savings, and are facing the same job insecurity.

- Shopper #1 may consider dark chocolate a necessity.

- Shopper #2 may be considering dropping down from an expensive salon brand shampoo to Pantene as a way of cutting costs.

- Shopper #3 is making a sacrifice by skipping Pantene for an off-brand shampoo.

Essentially, we still cannot assume consumers are all going to be making the same decisions regarding their spending, even if we include the factors outlined above.

Instead of income, the key attribute to analyze in order to develop a better strategy is discretionary income by category. This type of data empowers marketers to go a layer deeper, and not only understand who can technically afford a purchase, but who will choose to afford that purchase.

Discretionary spending changes by consumer segment AND purchase category

We have all seen consumer segments splinter in terms of preferences and behaviors a great deal over time. The key is harnessing the data that matters to your category, and your specific brand.

As an example, perhaps you are a home furnishings brand. Learning the income of your key audiences is a start. Better is understanding their discretionary income. Even better would be identifying your audience's discretionary spend habits to determine if they are willing to splurge on home furnishings, OR if dining out is where they choose to afford more. While dining out may seem an obvious luxury to some, for those who lack cooking skills, it may feel like a survival tactic.

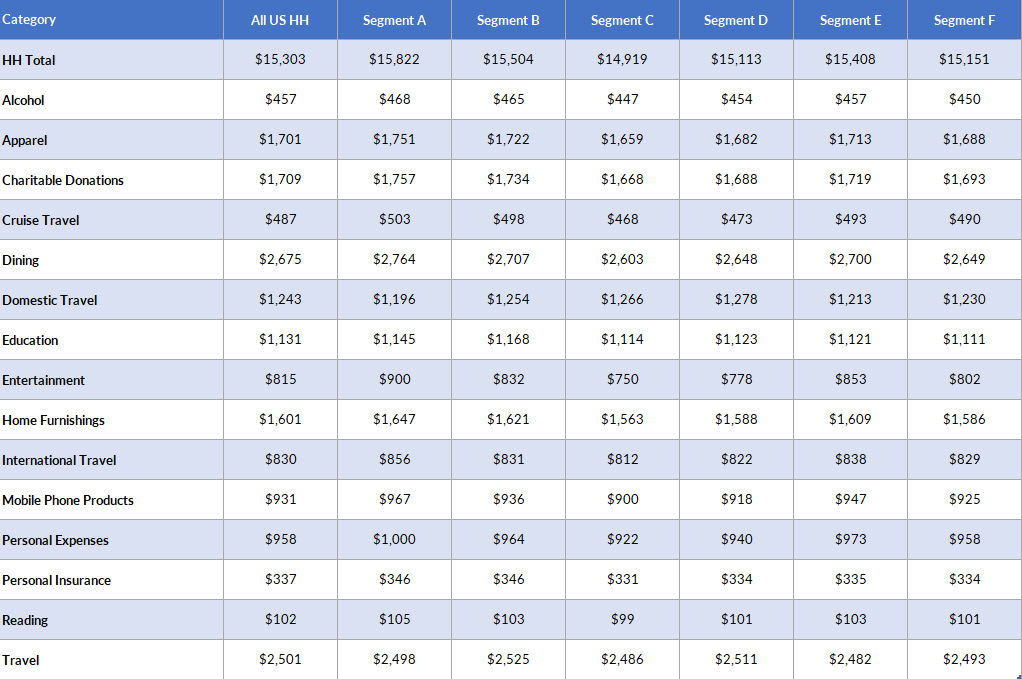

Spendex Example. Source: MRI-Simmons USA Fall 2022, Mean Spendex, HH weight.

Stop guessing, start knowing

Basically, we don’t really need to ‘guess’ anymore when a wealth of data is at our fingertips. We simply need to be willing to keep digging to find better indicators. Companies like MRI-Simmons and AnalyticsIQ are focused on analyzing ever-changing consumer buying behaviors and are uncovering new ways to find the answers every day.

And with predictive, granular data like AnalyticsIQ’s annual discretionary spend predictor – Spendex – combined with the deep insights into consumer behavior from MRI-Simmons, marketers can see the whole picture across thousands of targets, segments, and personas, and can profile consumers who have more money to spend on discretionary categories.

Organizations that continue to rely on their old ‘affordability playbook’ will continue to see diminishing returns and will rush to play catch-up with their more data-driven peers. As for me, I will continue to spike in the dining category for discretionary spending…but maybe I’ll look for a cooking class too.