The Data Quality Guide: How Raising Your Standards to Lower Your Waste Across Channels is as Easy as 1-2-3

Convergent TV requires high quality data

Data expertise is essential for being a strong marketing leader today. In fact, according to Gartner, over half of all decisions are being influenced by marketing analytics, and growing. And specifically when it comes to advanced TV advertising, the pressure is on to choose the right data with 70% of marketers stressing the importance of audience targeting for their cross-screen strategies.

While there are a plethora of data sources, media providers and analytics tools readily available, it doesn’t mean it’s an easy job for marketers to sift through the good from the bad. With data’s ‘linchpin’ role in the success of planning, executing, and measuring an omni-channel advertising campaign, it’s critical for advertisers and agencies to take a formulaic approach. By following the right process and asking the right questions, marketers can be prepared to identify, invest in and of course, reap the rewards of leaning into higher quality data solutions.

Our market research data quality guide below is the perfect place to get started. Keep reading to learn how to select the data best capable of delivering performance across screens, formats, and platforms.

Step 1: List the use cases your data must fuel.

Identify which roles and functions within your organization are using data today. Then, take note of all the use cases. Are there commonalities where a single data partner could potentially answer a larger spectrum of needs? For instance, some possible use cases include:

- Trend-spotting

- Market & competitor research

- Target persona creation

- Data enrichment

- Audience segmentation

- Custom modeling

- Cross-Channel campaign targeting

- Measurement and analytics

Step 2: Identify the data categories required to power your strategy.

CDPs and other first-party data centric companies will claim that you can only ever trust your own data. Prospecting tools and media platforms say the only way to scale is through third-party data. In reality, they are both right! Of course, knowing your customers is critical. But also knowing and identifying your competitors' customers, who could also be your future customers, is just as critical.

For data-driven advertisers and agencies, you can have your cake and eat it too by blending together the best of both first- and third-party data. By combining your first-party data with trusted, high quality third-party data, you can learn more about your customers, including which ones are engaging your competitors. From this integrated data you can create targeted segments based on demographics, interests, beliefs, and behaviors, and even create lookalike models to pinpoint valuable prospects.

To begin organizing a data strategy, outline the different core categories of data to consider including zero-, first-, second- and third-party data.

What is zero-party data?

Put simply, zero-party data is the data that a consumer offers willingly to you.

- According to Forrester, it may include preference center data, purchase intentions, personal context, and how the individual wants the brand to recognize her.

- Brands are building out small, micro-friendly digital experiences to solicit this information directly from consumers.

- Although zero-party data is a required component of any consumer-facing brand, in order to comply with preferences, it is rarely used for data-driven TV tactics.

What is first-party data?

First-party data is the customer data that a brand collects and owns

- Includes data points about how a customer has engaged with the brand in the past but is not shared as proactively by the consumer as zero-party data. Examples may include brand website activity, past purchases, and loyalty program data.

- Collected with consent and is typically only shared with external parties, like media buying agencies and marketing analytics providers, to support the brand’s marketing strategy.

- First-party data is rich and powerful, but scales only to existing or prior customers. It also offers a limited view, only showing how someone has interacted with a brand and not their overall lifestyle.

- This data requires a direct relationship between the brand and the consumer. This is a lot harder for some industries. For example, the beverage and CPG industries are at least one step removed from the buyer of their products, and consumers aren’t typically signing up for loyalty programs for each brand, they typically rely on the retailer programs for offers but then the retailer or distributor holds that relationship.

- First-party data is a common element of any data-driven strategy and serves as the fuel for retargeting and retention strategies. First party data is also powerful for addressable, one-to-one campaigns. However, depending on a brand’s footprint and performance goals, relying on first party data alone limits scale. For brand’s with millions dedicated to TV spend, additional third party data is required for scale.

What is second-party data?

Second party data is actually the first party data of a trusted partner.

- Collected directly from the consumer, so is highly accurate and reliable.

- It is often used to power strategies that are mutually beneficial for the data sharer and data receiver. For example, an airline may share a list of frequent fliers with their credit card partner to drive marketing campaigns aimed at co-branded card enrollments.

- Second-party data is the least commonly used category for most brands, typically only included when marketing products or programs as the result of a strategic partnership.

What is third-party data?

Third party data is data that is purchased from a data creator or aggregator which may include B2C or B2B data.

- Depending on the provider, the data may be collected directly or indirectly from the consumer but you should make sure it is always operating within privacy guidelines.

- The available data points are typically broader including everything from basic demographics like marital status and income, to highly sophisticated data points about competitive buying behaviors and even ad break preferences.

- Third-party data is required for data-driven customer acquisition strategies. This makes it the most widely used data category for advanced TV buying teams.

- This category has the greatest volume of providers and a wide range of quality, making selection a challenge.

After assessing the types of data, let’s talk about making the best data partner selections for your strategy.

Step 3: Identify the right data by asking the right questions.

Poor quality data contributes to media waste and missed opportunities. But accurate, predictive data can be utilized throughout the media buying process. Understanding market research data quality can feel like a vague process. But our checklist of questions below will help you separate the good from the bad.

1. Are the differentiators meaningful or are they red herrings?

Niche data providers can distract buyers by focusing on labels like “deterministic” or “probabilistic” data, but the industry as a whole has evolved past these labels. Sophisticated buyers understand that both actual and modeled data can power campaigns. More often than not, probabilistic data is being used to power TV strategies.

Deterministic and accurate are not interchangeable terms, but two distinct ways to evaluate data quality. High quality data is created using deterministic data points to fuel sophisticated predictive models, resulting in, you guessed it, probabilistic data. In fact, many media buyers today who are choosing ‘off-the shelf’ audience segments from their DMP or DSP don’t even realize that an overwhelming majority of audiences are actually probabilistic, modeled from a deterministic seed dataset.

2. How is this data sourced?

Data creators focused on quality find a balance of source trustworthiness as well as scale. Most important is that the data must be reflective of the population’s diversity across age, gender, ethnicity, income, location and more, just like MRI-Simmons’ syndicated research studies.

For example, MRI-Simmons employs probabilistic and address-based sampling, widely considered to be the gold standard methodology by marketers and researchers alike. While competing methodologies (like opt-in online panels) rely on the same or similar set of respondents many times, probabilistic address-based sampling requires random recruitment of potential respondents for each study. When conducted across tens of thousands of respondents, this sampling methodology allows marketers to examine granular slices of the market without compromising the stability of insights.

Ultimately, similar to MRI-Simmons, you’ll want to make sure your data partner can:

- Disclose how they are collecting the data (surveys, transactions, data scraping)

- Identifying how they select who to capture data from (often called the sample design)

- Adhering to local and federal consumer privacy policies

- Owns the rights to the data they are providing

- Unbiased panels and data collection practices

- Ability to capture the true diversity of the US market

- Deep and wide insights

- Reputable industry accreditations

- Broad application of use cases

3. Is the data unbiased?

As we just mentioned, it’s important to make sure that even if you trust the source of the data you are utilizing that it is not skewed. This bias may over-represent some populations and under-represent others. This is an especially important consideration as many organizations continue to implement DEI initiatives both within their organization, amongst vendors and through their marketing.

So how do you ensure unbiased data? Online convenience panels that focus on scale alone tend to capture a large number of similar looking respondents. In exchange for speedy results, you also end up with a biased sample of “professional survey takers”.

Recruited panels built on address-based sampling, deliver the best of both worlds - privacy safe opt-in data, detailed responses, and representative of the full population.

4. Is the data fresh?

Data can be accurate, but slow moving. Fresh data is especially critical for brands connecting with consumers during periods of rapid innovation and intense competition.

TV viewing has experienced a major shift with much of people’s time moving from linear to streaming. Knowing where people are moving their attention in the fast paced world of media is mission critical.

5. Is the data unique?

Today’s data landscape is competitive to say the least. Simple variables like age are lower than table stakes. Real human-centric data will include aspects of the consumer like their attitudes, opinions and values for more nuanced audience creation that connects with hearts and minds.

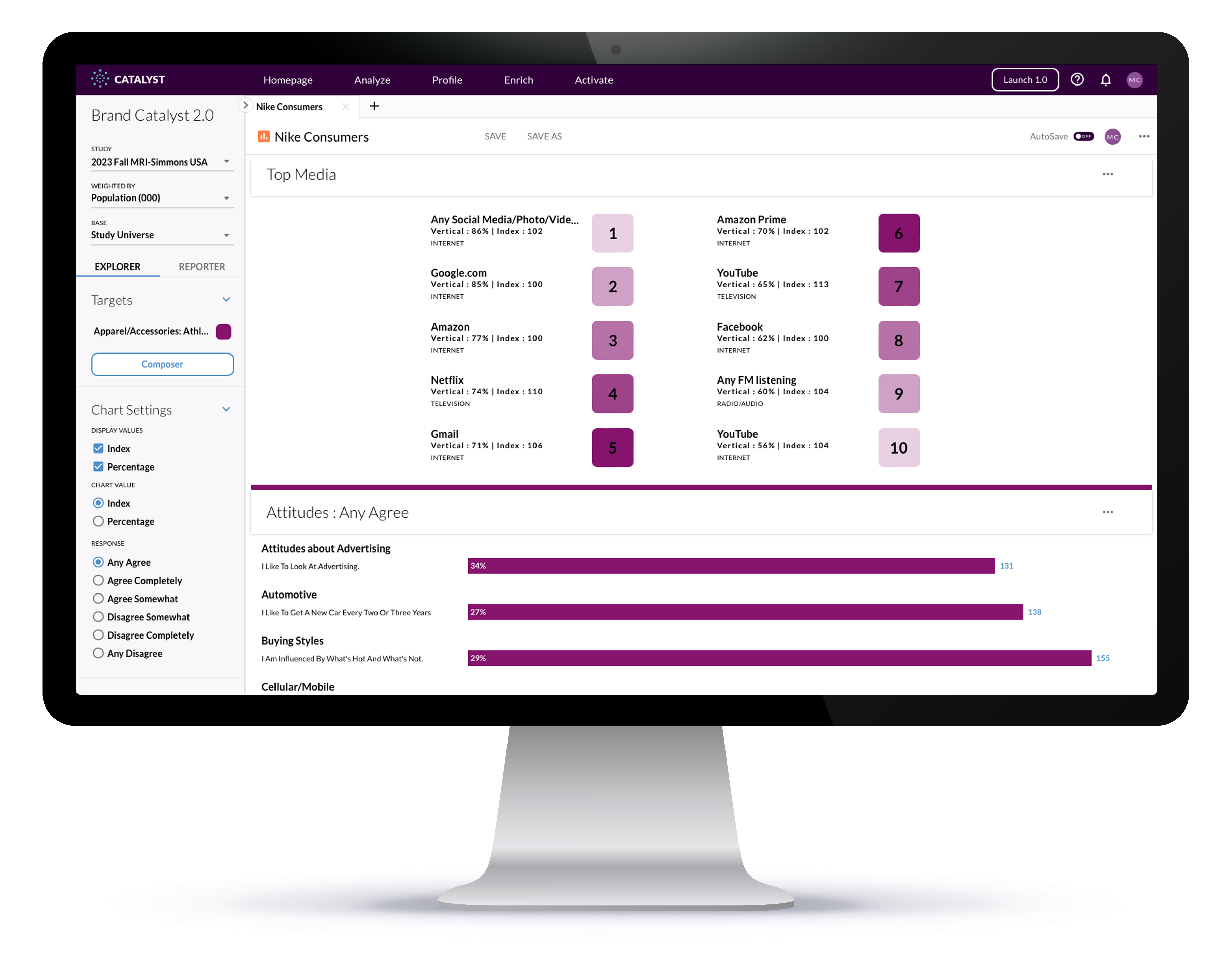

Let’s say that you are a retailer looking to launch a new athletic shoe line to rival a leading sneaker company like Nike. Wouldn’t it be incredible to understand everything you can about who is already purchasing that specific brand today?

6. Does the data tell the full story?

Niche datasets can include rich details, but without a broad view can miss the point. A complete dataset will include everything from basic demographics to purchase behaviors, to media consumption to drivers for why they make the choices they do. Even better is when you have a single source that can provide the ability to connect all the dots and really help you understand the relationship between the various attributes that are critical to drive your business.

For example, MRI-Simmons measures:

- 60,000 consumers elements

- 1,000+ attitudes & opinions

- 800+ lifestyle elements

- 6,500+ brands

- 1,000+ product categories

7. Can the data scale?

If the data only features a few thousand records, that's not enough. Your foundational data asset should reflect the size of the country with approximately ~250M+ individuals and 120M+ households represented. Size is one critical component for scalability but so is identity and coverage. Make sure your data supplier has the ability to onboard their insights into an activation platform. Without this ability you will find yourself recreating the targets you wish to engage for a campaign leaving extra work and an inability to understand what is actually working or not working.

8. Who is validating the quality of the data?

Are the data providers accredited by any industry organizations? Which third parties are testing and validating market research data quality? Organizations like the MRC exist to move the industry forward. Regular audits from outside parties are one way to ensure providers are seeking to operate with greater transparency, to both clients and consumers.

9. Is the data built with privacy in mind?

The regulatory environment is ever evolving, forcing good data creators to stay three steps ahead when it comes to privacy and data security. Self-reported sources that are opt-in are ideal to remain privacy-compliant, even with new legislation. Especially since those responses are simply used to fuel insights and powerful lookalike models from which those respondents are suppressed.

Not making a choice delivers mediocre results

As TV buying and planning becomes more and more data-driven, the options can feel overwhelming. Some teams compensate by simply not making a choice, and “testing” everything.

In practice you may see this as a CTV buy executed against 500+ data segments in a programmatic platform. While the buyer has the best of intentions and selects every variable with a keyword related to the product, what they get is a campaign fueled by conflicting data segments, none of which run at a volume high enough to effectively test performance.

Tomorrow’s TV leaders are not indecisive. We are privileged to work with forward-thinking teams every day, thoroughly evaluating and testing their options to ensure their TV strategy is set up to dominate the market. This is true for leaders on both the buy and sell-side. Sell-side leaders understand that market research data quality is the key to unlocking better yield and monetization of their valuable inventory. Buy-side decision makers know that better data empowers better negotiation and media selection to make the most of every dollar.

Unsure where to start? As marketing pioneer John Wanamaker said “One may walk over the highest mountain one step at a time.” Lucky for us, selecting the right data is really more like a bunny slope, especially when you partner with someone who has navigated the terrain before. The MRI-Simmons Advanced Advertising team works alongside TV, Agency, and Brand leaders every day to help maximize performance for even the most niche use cases, and across every format from linear to CTV to mobile video. Reach out today to start improving the quality of the data powering your strategy.