3 Things all employers should pay attention to in 2023

It’s no surprise that rising interest rates and product costs have impacted how Americans feel about US economic conditions. In fact, most American adults (67%) – over 170 million people – think the US economy is in worse financial condition than 12 months ago, and almost half (48%) think it will be worse 12 months from now. While many are not confident in US economic conditions, over one third – nearly 88 million Americans – think their household will be financially better in 12 months. Knowing how Americans feel about national and personal finances raises the question, How do Americans feel about their employer’s financial state?

MRI-Simmons’ latest Trending Topics Study explored the questions…

- Do Americans believe their employer is better off or worse off financially than one year ago? Will they be better or worse one year from now?

- Are Americans confident in their employer’s revenue growth?

- How many Americans are freelancing to earn extra cash?

- What kinds of activities are Americans doing in response to inflation? Are these behaviors changing?

From these key questions, a few themes emerged.

1. The gig economy is growing (and that could be a good thing for employers)

The gig economy and our growing culture of side hustles show no sign of slowing down in 2023. With inflation draining finances for many US households, side gigs are being pursued to supplement income for both part-time and full-time employees in the US.

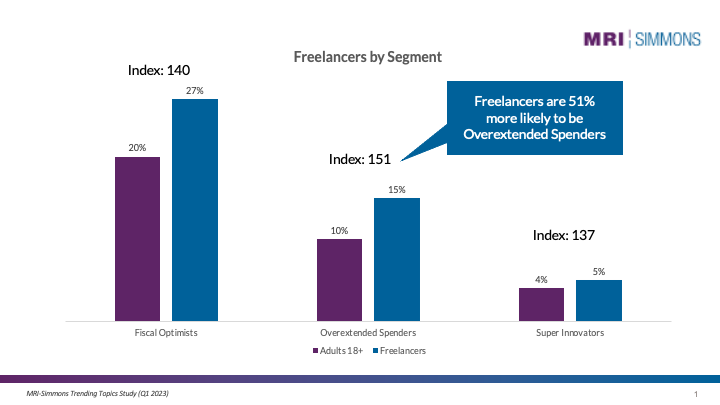

Revealed from MRI-Simmons’ latest Trending Topics Study, over 1 in 4 adults – nearly 70 million Americans – offer services as independent contractors or freelancers to earn extra money. These side hustlers skew young, male, single, and affluent, and over 70% are earning freelance cash on top of the salary or wage of a main job. According to MRI-Simmons’ USA segmentations, freelancers are more likely than the average American to be Super Consumer Innovators (the first to try new leisure activities, tech and financial products, and food trends), Overextended Spenders (excited by the financial markets and willing to take investment risks despite debts), and Fiscal Optimists (have positive expectations for their fiscal future). They are also 82% more likely than the average American to be ‘very confident’ in their employer’s revenue growth, which is a good thing for employers as heightened employee confidence is likely tied to perceived job security and increased satisfaction.

Another 60 million Americans (24%) are considering freelance or contract work, and they also skew young, single, and are more likely to work in IT, HR, research, and sales jobs. One could theorize that the convenience of computer-based remote work is a contributing factor to considering a side hustle – the ease of switching from one job to the next in the comfort of sweatpants and fuzzy socks could tempt some Americans to earn the extra cash. It turns out what’s really driving these Americans to consider a side gig is financial struggle. Americans considering freelance work are more likely than the average American to worry about retirement, hold off on big purchases, and feel overwhelmed by financial burdens. This group is 32% more likely to feel their household is financially worse now than 12 months ago, compared to Americans who already freelance.

Freelancing does appear to reduce financial burden, as employed American freelancers are 36% more likely to believe their household is financially better now than one year ago and 33% more likely to think it will be better one year from now (compared to the average American). Furthermore, the stigma of having and talking about a side hustle is shifting as younger generations welcome them as a smart financial decision. There are over 51 million Millennial and Gen Z freelancers in the US, and they are 38% more likely to want to make it to the top of their profession, 29% more likely to want to start their own business, and 28% more likely to consider their work a career (than the average American). Employers should stay on top of the gig economy trend and not only accept side hustles as part of employees’ lives, but also embrace and create a space for open conversation about them.

2. Employees are confident about their personal financial future

Among the 155 million Americans who are employed in the US, 60% are confident in their employer’s revenue growth in 2023, indicating the current state of the US economy isn’t overwhelmingly impacting employee confidence for the worse. In fact, 23% of US employees agree their employer is financially better now than 12 months ago (Index: 127), and 27% feel their company will be better financially one year from now (123).

When thinking about personal finances, 33% of US employees feel they are better now financially than 12 months ago (120), and 41% believe they will be better one year from now (119). These percentages are strengthened when employees add a freelancing gig into the mix, changing to 37% and 46% respectively.

Compared to consumer confidence in the US economy, Americans hold a higher sense of trust in their personal and employers’ finances despite the aches of inflation. Employers should keep this in mind when making business decisions in 2023 to maintain and strengthen employee confidence.

3. Americans are making fewer lifestyle changes in response to inflation

Responses to inflation in the US have encompassed cutting back on purchases and entertainment, shopping at discount stores, clipping coupons, switching brands, dipping into savings, taking on side hustles, and more. According to MRI-Simmons’ Trending Topics Study, fewer Americans are making these lifestyle changes now than six months ago.

In September 2022, nearly 50% of Americans reported driving less to save on gas, dropping to 39% in March 2023. Increased willingness to drive could lead employees to return to the office or start hunting for a new job, activities that may have seemed daunting to Americans throughout the past year.

A similar drop occurred for coupon clipping, with almost 93 million Americans searching for savings in September and only 78 million still clipping in March. We see other activities moving toward normalcy with more Americans eating out at restaurants and attending events like concerts and sports games – Americans are ‘getting back to normal’ from their initial responses to inflation earlier in 2022 despite increasing interest rates and product costs.

Are Americans growing accustomed to higher interest rates and prices, and therefore making fewer financial lifestyle changes? Will these inflation responses continue to dissipate in 2023? Are Americans feeling more optimistic about the US economy? Will employees remain confident in their personal finances as the year progresses? Will side hustles become the norm? MRI-Simmons will continue to explore these shifts in our quarterly Trending Topics Study.

For more information about the Trending Topics Study, click here or contact us today.

MRI-Simmons’ Trending Topics Study explores current behaviors and future intentions as they relate to “what’s trending”. Topic areas may change from wave to wave to stay relevant and focus on current events. With this study, clients can learn more about consumers’ changing habits and mindsets, get a snapshot of what’s hot or what’s not, or identify real-time areas of focus for their brand.