What’s Trending: Profiling the Crypto Investor

Cryptocurrency, recently a foreign concept to most, is growing in popularity. 50 million Americans (18 or older) have purchased or traded some form of cryptocurrency in the last 12 months – and 59 million plan to in the next 6 months.

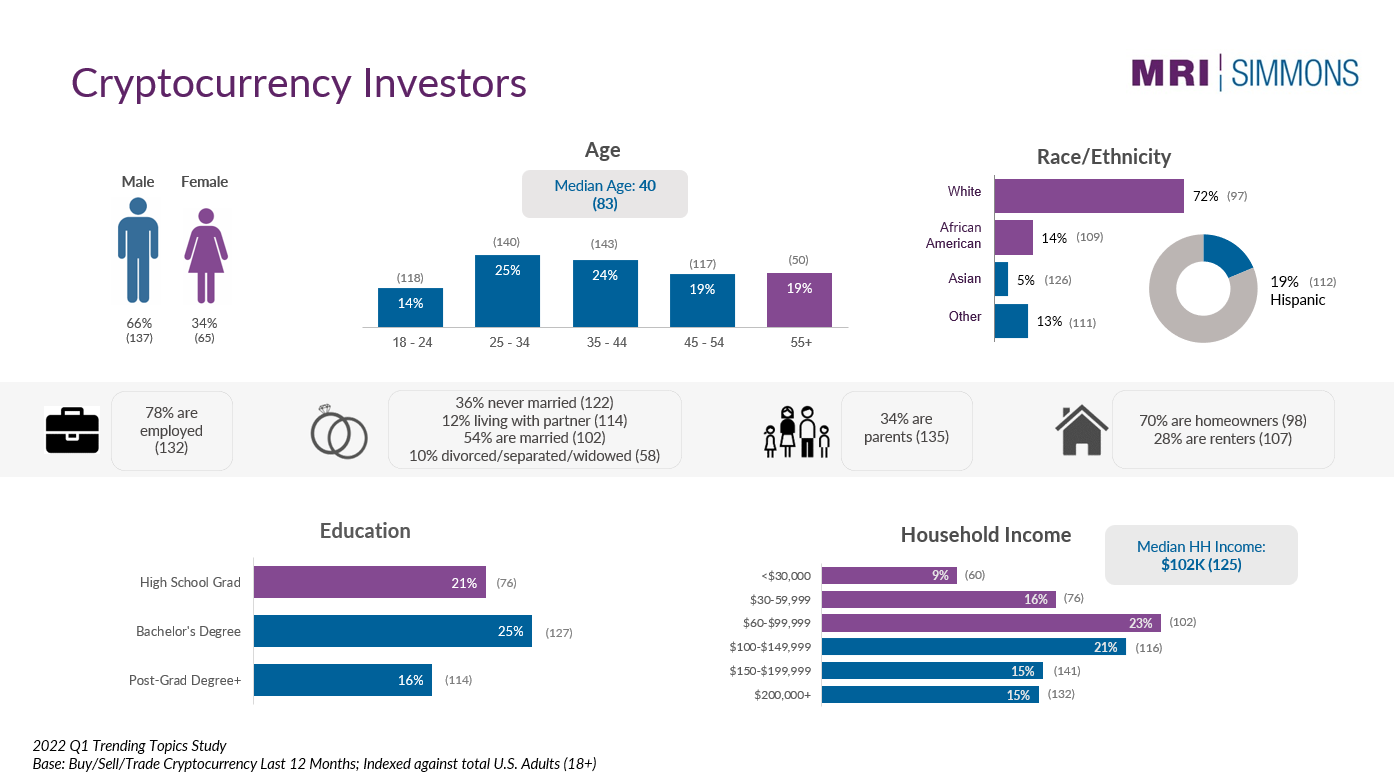

So, what do we know about crypto investors? We know they are a desirable audience: They skew male, single, highly educated, and affluent, with a median age of 40 and a median household income of $102K. While they enjoy a variety of leisure activities, crypto investors are more likely than the average American to participate in fantasy sports leagues (Index: 155), play console video/electronic games (Index: 147), and play in or attend e-sports events (Index: 149/160).

Regarding their other investment activities, 36% of crypto investors – about 18 million Americans – have used cryptocurrency to make a purchase in the last 12 months (Index: 281) and 43% plan to in the next 6 months. This is big news for companies now entering the metaverse, such as retail giant Walmart and apparel retailers Gap, Urban Outfitters, Ralph Lauren, and more (source).

Another investment opportunity that interests crypto investors is collecting NFTs (non-fungible tokens). In the last 12 months, about one-third of crypto investors collected or traded NFTs (31%; Index: 336) and 34%, or about 17 million Americans, plan to in the next 6 months (Index: 285). Even though interest in NFT investment is growing, over 115 million Americans report they would be more likely to trade NFTs if they didn’t have to use cryptocurrency.

So, what drives these investors’ attention to crypto and NFT trading? It could be their undying optimism about the US financial market. Crypto investors are 49% more likely to believe the US economy has improved in the past year than the average American, and they are 40% more likely to believe the US economy will be better one year from now. This population also has somewhat different attitudes about finances overall; crypto investors are 45% more likely than the average American to enjoy risk-taking for a chance of a high return, and they are 38% more likely to feel excited about the ups and downs of financial markets.

Cryptocurrency and NFT trading are fairly new concepts to most Americans – there is much to learn about how these virtual markets impact consumer behavior now and in the future.

MRI-Simmons’ Trending Topics Study explores current behaviors and future intentions as they relate to “what’s trending”, including topics in finance, health and fitness, COVID response, ethics and values, and more. Topic areas may change from wave to wave to stay relevant and focus on current events. With this study, clients can learn more about consumers’ changing habits and mindsets, get a snapshot of what’s hot or what’s not, or identify real-time areas of focus for their brand.

For more information about the Trending Topics Study, click here or contact us today.