Advanced TV in the New Reality – Part 1

With more people at home, TV is back for its throne, making audience-based targeting more important than ever

As COVID-19 compels businesses in the US to find a “new-normal”, how will marketing leaders endure in these unprecedented times? MRI-Simmons sees this global pandemic permanently altering Americans’ video & TV consumption, which was already rapidly evolving before the virus arrived. Advanced TV will grow in this new age by reaching consumers where they spend the most time, and ultimately, offer marketers a best-of-both worlds combination of the targeting and reach of digital, and the unmatched scale and penetration of traditional TV. This blog post (the first in a series of three) will explore current dynamics in the advanced TV space.

Firstly, let's define advanced TV. From a consumer’s standpoint, it can mean delivering high quality video content on demand, easily watched anywhere on any type of device. For the marketer, advanced TV means the ability to deliver ads next to high-quality on-demand content using people-based audiences, going beyond the traditional show, daypart, or age/gender of “traditional’ TV ad targeting.

OVERALL VIDEO CONSUMPTION BOOM

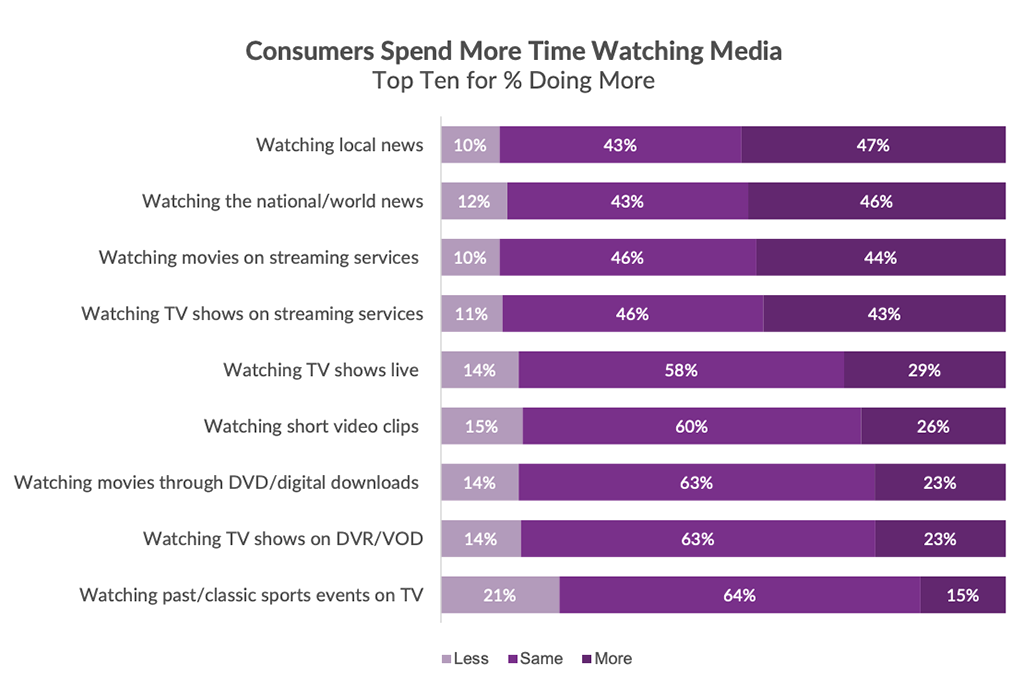

According to MRI's Survey of the American Consumer (Fall 2019), the average American household has 2 TV sets, and smart TVs are in 35% of US households. With the COVID-19 crisis in full swing, families are suddenly closer than ever to each other (at least physically), and subsequently to those devices. Savvy marketers get the message, more people at home means more TV viewership, and now the initial research supports it: Insights from MRI-Simmons’ recent COVID-19 Study shows that since the news of the pandemic hit, consumers are watching more news (+47%), streaming more movies (+44%) & tv shows (+43%), and even short video clips (+26%) to pass the time.

Source: MRI-Simmons' COVID-19 Consumer Insights Report (Apr 2020)

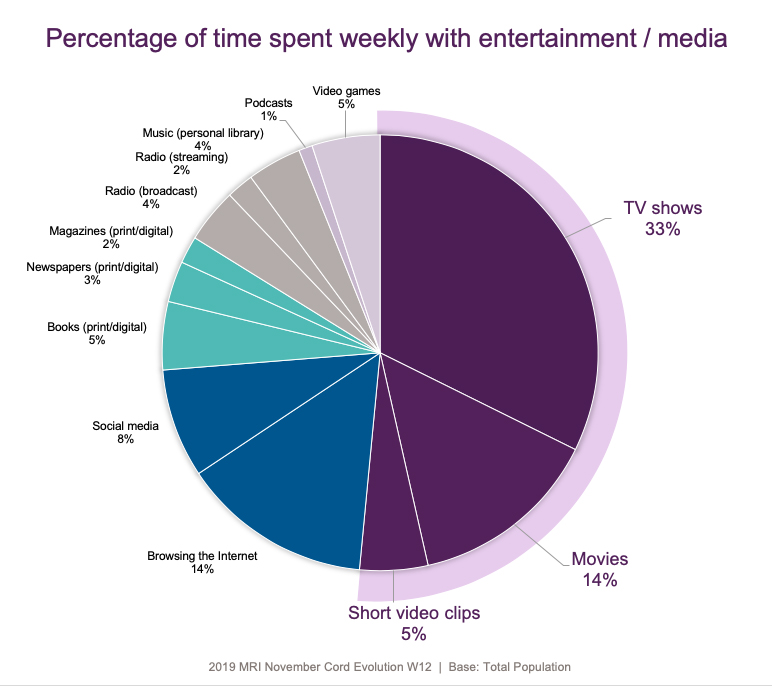

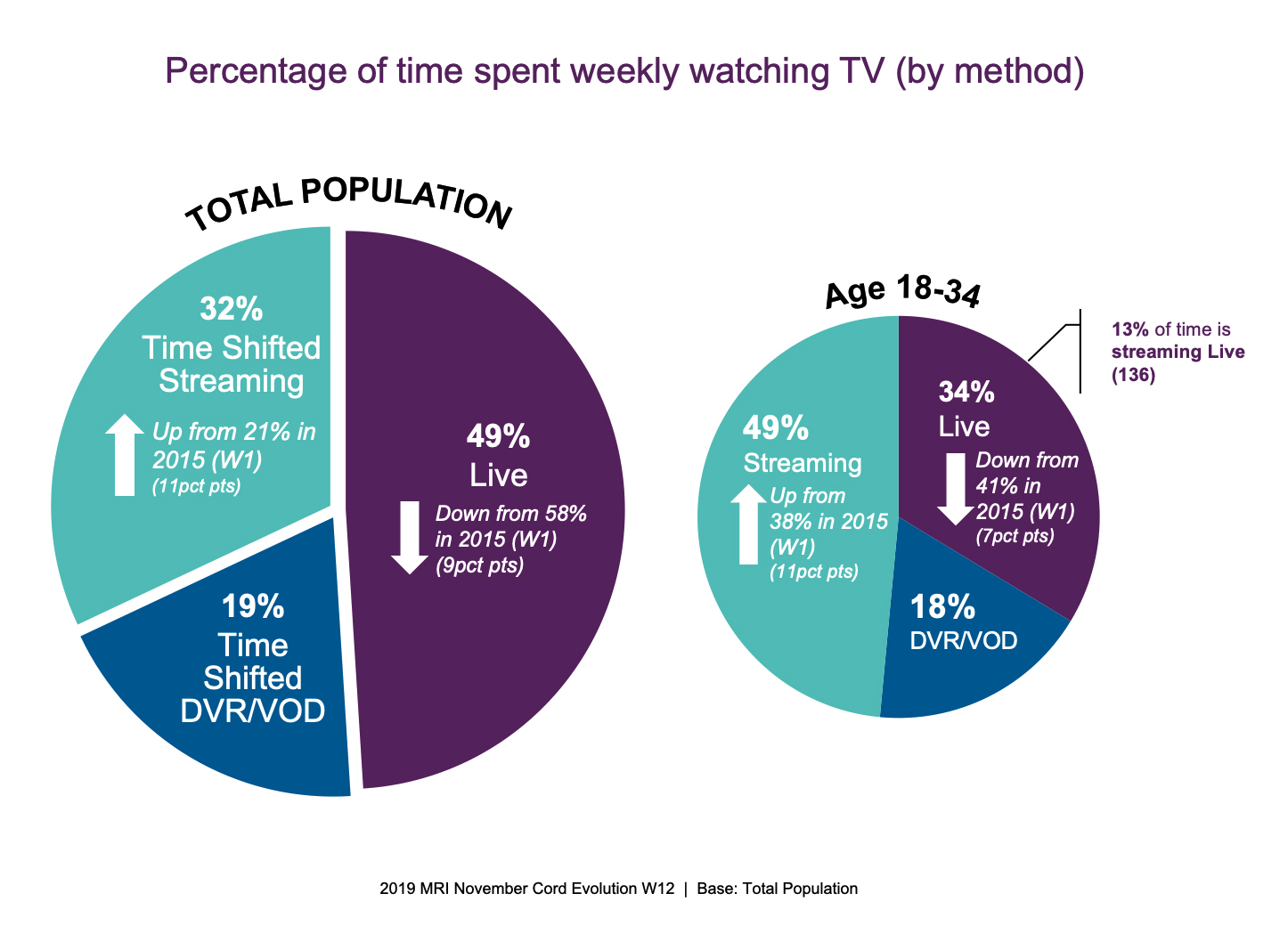

Even before COVID-19 ‘shelter-in-place’ mandates, consumers watching video already took up more than half (53%) of American’s media time in a typical week (MRI Cord Evolution Study), and TV viewing is happening in more ways and on more platforms than ever before. In parallel, time-shifted streaming is up 11% from 21% in 2015, to 32% in November 2019.

However, while most TV time was still watched live, this trend had been declining (down 16% from 2015) even before the crisis, with the sudden absence of live sports and events.

For marketers in a post COVID-19 world, this means that quickly identifying the viewing mix of one’s target audiences becomes a necessity, not an option.

ADVERTISING SHIFTING TO ADVANCED TV

So, video consumption is up, but are the ad dollars following suit? The answer is overall, yes. According to insights from TV data measurement company Samba TV, ad investments from linear TV to OTT-based viewership has increased significantly during the COVID-19 era. Samba observed that ad requests to both Connected TV (CTV) and Over the Top (OTT) platforms increased by 71% since the start of the COVID-19 crisis, as compared to a 32% increase in linear TV. This shift will largely remain even after the crisis subsides & Americans return to work.

TV ‘STACKERS’ TODAY AND TOMORROW

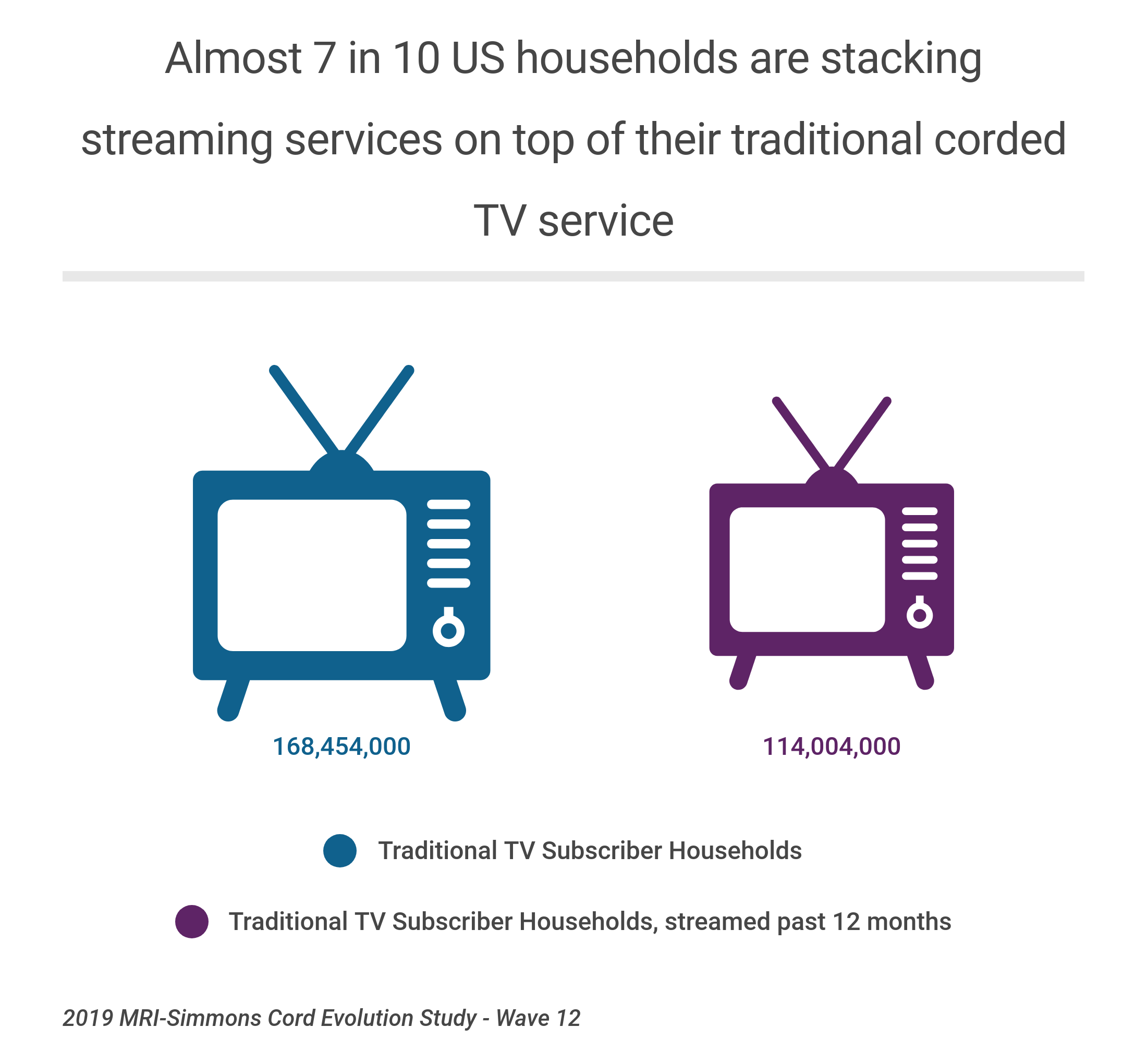

Let’s discuss the average American’s expenditure for video consumption at home before the crisis began. According to MRI’s Cord Evolution study, 68% of Americans still have a cable, satellite, or fiber optic subscription – a “Traditional TV” household. Of these, almost 7 in 10 say they pay for a streaming service, or “stack” subscriptions to watch content not available in their traditional TV subscriptions. These “Stackers” spend over $125/mo on average with these services. What will happen to these “stackers” in a post COVID-19 world? As the latest US unemployment rates continue to break new records, and households across the US will need to re-examine their budgets, will they decide to cut the cord at a faster pace than before? Will they trim streaming services due to financial constraints? Or will they trim elsewhere to maintain their entertainment budgets? Time will tell, and we will track these behaviors in future MRI-Simmons Cord Evolution studies.

AVOD & THE BOOM FOR ADVANCED TV AD INVENTORY

As household budgets shrink and the demand for Advanced TV / OTT remains high, we see potential for accelerated growth in ad-supported video-on-demand (AVOD) services like Tubi, Crackle, Pluto, as well as upcoming ad-supported tiers of NBC’s Peacock & HBO Max. Ad sales teams have an opportunity to sell ad inventory more relevant for the consumer, while maximizing the efficiency of their inventory. With an increasingly fragmented consumer landscape, media will be looking for data to demonstrate consumers’ brand affinity.

The common factor for these trends is that in these times, as marketers will demand more from their advertising dollars, we predict the increase of advanced TV to deliver on its promises of reach and brand awareness, especially when coupled with the right form of audience-based buying.

In part 2 of this 3-part blog series, I’ll discuss key challenges marketers face in the advanced TV space.