Advanced TV in the New Reality – Part 2

Outlining the challenges in the advanced TV space

As we examined in Part 1 of this blog series, consumers are viewing more video, but current challenges with Advanced TV remain.

CONTENT WARS

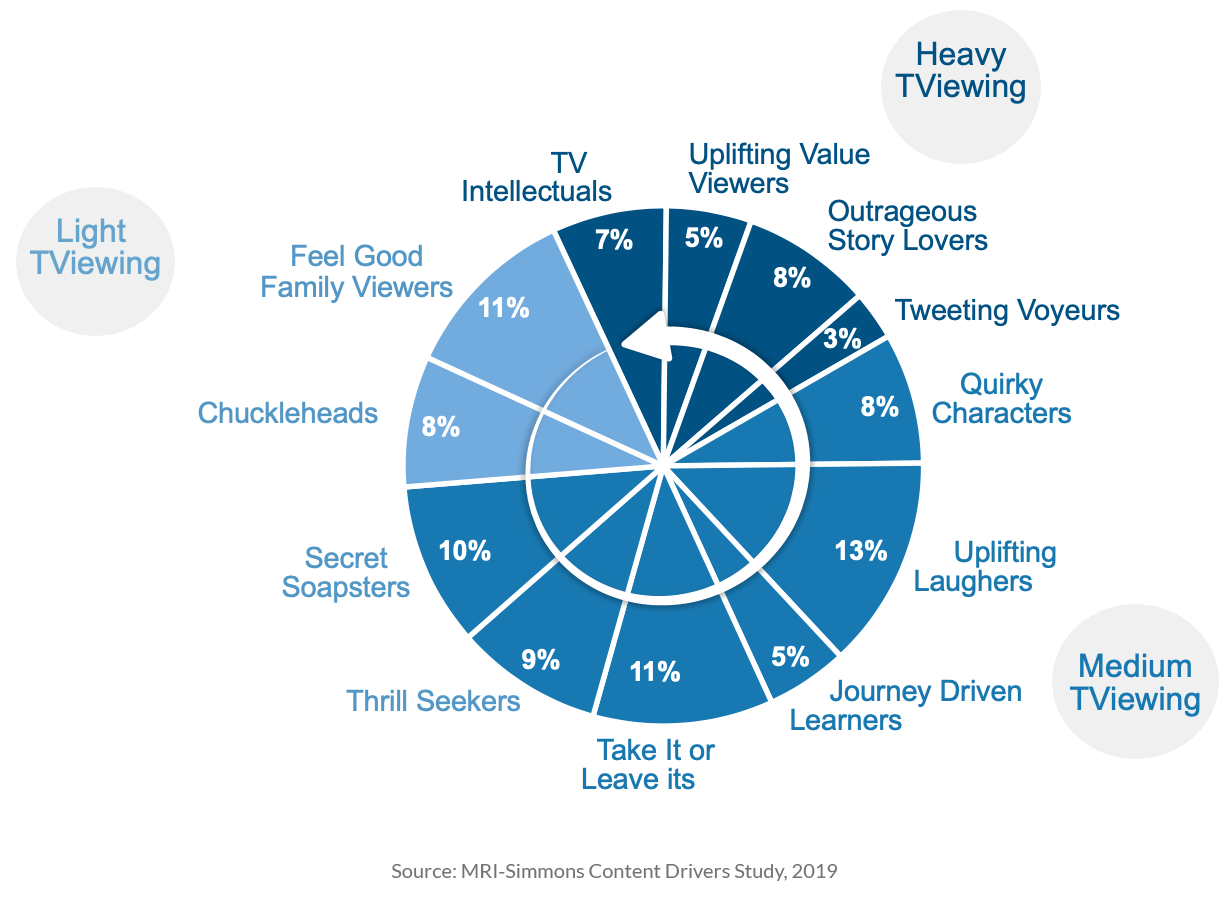

Even when spending more time at home, there is only so much time in a day to watch TV. The industry has responded with an arms race for both quality and quantity of content. Case in point, the number of streaming services and apps measured in the MRI-Simmons Cord Evolution Study has more than tripled in the last 4 years – from 40 services in 2015 to over 170 in 2019. In parallel, MRI-Simmons Content Drivers Study now measures over 500 TV and streaming programs, helping marketers understand the emotional drivers to content. This study shows that viewers are being segmented into more buckets than ever before (now 12 distinct viewing segments), because their options of what to watch, and the emotional benefits are richer and more complex than ever before.

Armed with this type of research, a marketer will be able to cross-reference & pinpoint both the ideal streaming services and viewing behaviors for their consumers, enabling more efficient TV ad buys to reach their target audience.

FIGHTING FRAGMENTATION

The fragmented content landscape described above not only makes it harder for marketers to find their audiences, but also TV measurement and attribution has never been more difficult. A marketer needs to measure viewing across content platforms & which impressions attribute to business outcomes, all the while controlling for frequency. Fortunately, marketers are learning that they can use the same research used in the TV planning process to address many of these issues. With advanced audiences established upstream during the planning process, these same audiences serve as a common standard to purchase inventory across the proper TV platforms & content sources. As mentioned in Part 1 of this blog series, these same audiences can align both subscriber-supported (SVOD) and advertiser-supported streaming video services (AVOD) to include in a TV plan - outpacing all other video consumption in a post-COVID-19 world.

Regarding TV attribution, if a marketer starts with audiences from the planning stages, the audience remains consistent and is brought through the customer journey. This way the marketer can compare the audience they started planning with to those that actually viewed the ad, and eventually performed a business outcome. As a reminder, in this approach it’s important to understand ahead of time if these audiences can easily be ported to channels that were historically less apt to apply data for targeting – e.g. Linear TV.

DATA INCONSISTENCY AND A DATA “TRUTH-SET”

Data inconsistency is not new to the ad industry, but it’s made worse in advanced TV because of non-standardized ad formats and different delivery systems. As there is no ‘official’ advanced taxonomy in advanced TV (we believe that MRI comes close!), there are many ways to derive a TV audience. Advanced TV’s data advantage fades quickly if the data used to create audience segments is inconsistent and yields poor results.

A reason for this inconsistency could be that the audience data in each of these fragmented environments is typically sourced from proxy data or different providers. For example, let’s imagine a marketer who wants to reach an in-market consumer for a Ford auto. They could go to any number of sources of data to produce this target: location data with car dealer lot visits, transaction data (oil changes & auto parts), or survey data: asking consumers directly if they are intending to purchase a Ford in the next 6 months. Still another source is a marketer’s own 1st party data: if a marketer has their own customer data that can help target in-market consumers. However, these different data sets employ different methodologies to collect, model, and size to a target audience. For all these reasons, an “in-market Ford” target segment could vary widely in makeup and effectiveness when used for targeting a TV campaign.

So, how would a marketer understand the variance and make sure their TV impressions don’t go to waste? To do so, one needs to establish a “truth-set” of data – a high quality data source, ideally independently audited and widely adopted – in order to gauge consistency and accuracy. Once this data truth-set is established, a marketer can either use this with their preferred data onboarding partner to expand to programmatic-appropriate scale, or use to validate another data source (even the marketer’s 1st party audience) and confirm its audience profile.

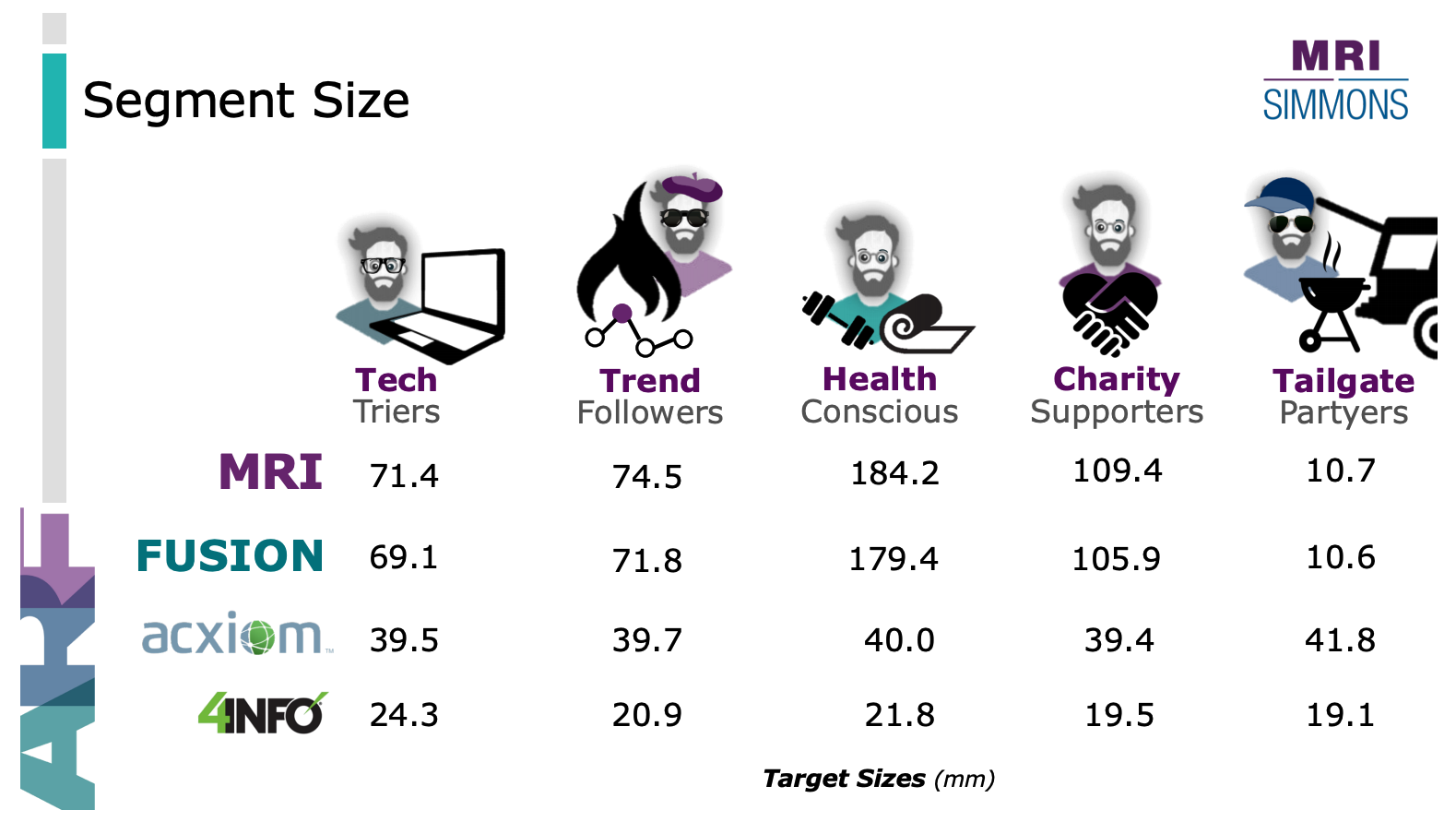

For example, In the following presentation by the ARF (Advertising Research Foundation), onboarding company Acxiom worked with TV Platform Clypd and MRI-Simmons for a client to establish market sizing & consistency across different data sets for a set of attitude-based targets. For example, amongst a given target, e.g. “Charity Supporters”, the team could use a truth-set to control for variances in target size and composition across the clients DMP & other data partners’ target profiles.

With this knowledge, the marketer was able to better understand the value of their advanced audiences, validate their accuracy for their campaigns, and establish consistent media buys across disparate channels – TV, digital, email, social media, etc.

Because of the challenges above, supporting an advertising buy with the same audience across multiple disparate channels – TV, digital, email, social media etc. - becomes impossible when audience data sources cannot be applied with consistency. Fortunately, the right type of audience-based planning and targeting approach addresses many of these issues.

In Part 3 of this blog series, I’ll unveil the key to achieving positive results with audience-based TV Buys.