How to Win Over America’s Holiday Shoppers All Season Long

As pumpkin spice lattes return and Halloween decorations are clearing the shelves, Americans are already plotting their Winter holiday shopping strategies. According to MRI-Simmons’ Retail Trends Study, 35% of adults (about 92 million people) plan to finish their holiday shopping by mid-November this year. Another 29% (75 million) are holding out for Black Friday weekend, while 13% (34 million) will wait until December to make their purchases. These three distinct waves of shoppers – Early Birds, Black Friday Weekend Warriors, and Last-Minute Gifters – offer marketers a rare trifecta of opportunity.

Early Birds: The Research-Driven, Store-Loving Strategists

Early bird shoppers are holiday MVPs. They’re organized, intentional, and deeply skeptical of chaos. With 35% of American adults aiming to finish their shopping by mid-November, this group skews for being Gen X and Boomer women, indexing at 112 and 117 respectively (compared to the average US adult). Nearly half (49%) plan to complete their shopping before November, and the other half (51%) wrap up just before Thanksgiving. With inflation still lingering and shipping delays continually making headlines, 28% of early birds are shopping sooner to avoid price hikes, while 24% fear shipping delays and 19% worry about out-of-stock products.

These shoppers are also deeply intentional. 71% are spending more time researching brands than ever before, 67% care about the origin of the products they buy, and 66% are shopping more to support local or small businesses. And while they love browsing in stores (46% shopped mostly or only in stores last year), hesitations persist as 64% worry they won’t find what they want in stores. They are financially conscious, as they’re 22% more likely than the average adult to be influenced by installment payment plans and 17% more likely to appreciate a variety of payment options. But they are not easily swayed by hype. Black Friday? They’re over it. 80% say the sales event is overrated.

Tips for engaging Early Birds?

- Launch “Shop Early, Shop Local” campaigns that spotlight small businesses and ethical sourcing.

- Use storytelling to highlight product origins. Think behind-the-scenes videos or artisan profiles.

- Offer flexible payment options and mobile-friendly browsing to meet their tech preferences.

- Create early-access bundles or loyalty perks for pre-Thanksgiving shoppers.

- Tap into their research mindset with comparison guides, product reviews, and curated gift lists.

Black Friday Weekend Warriors: The Experience-Driven, Tech-Savvy Deal Seekers

Black Friday weekend is still the Super Bowl of shopping, and 29% of American adults (75 million people) are suiting up for the occasion. These shoppers skew younger, with Gen Z men (index 145) and Gen Z women (index 131) leading the charge. They’re also more likely to have kids at home (index 131), which adds urgency and complexity to their shopping lists. Most plan to complete their shopping on Black Friday (56%), while 30% will shop over the weekend and 14% will wait for Cyber Monday, making it a multi-day opportunity for brands and advertisers.

This group is highly responsive to digital engagement. 60% find video ads on social media more engaging than traditional formats (index 123), 53% often click on video ads to shop for featured products (index 125), and 54% want to scan QR codes while streaming TV to buy items they see (index 134). They’re also drawn to novelty with 58% actively seeking out new and unique brands.

In-store, they want experiences. They’re 24% more likely to value product tutorials from store employees, 23% more likely to appreciate interactive displays, and 22% more likely to enjoy in-store amenities like coffee shops or nail salons. Online, they’re 62% more likely than the average adult to be influenced by shopping bots that compare prices, 53% by live chats for product advice, and 32% by specialty or handmade items.

Interestingly, only 56% of this group typically give gifts during the holidays which means the rest are likely hunting for personal upgrades. Think gaming consoles, fashion, and tech. And this year, 72% will be hoping for grocery deals, making food and beverage brands a surprising but strategic player in the Black Friday mix.

Tips for reaching Black Friday enthusiasts?

- Run TikTok and Instagram campaigns with shoppable video ads and influencer product demos.

- Integrate QR codes in connected TV ads and influencer content to drive instant purchases.

- Offer live chat support and product tutorials to enhance the shopping experience.

- Offer exclusive Black Friday bundles with limited-edition or handmade items.

- Create hybrid retail experiences like pop-up coffee bars, AR product try-ons, or scavenger hunts.

- Don’t forget grocery brands. Bundle food deals with gift items for a cross-category win.

Last-Minute Gifters: The Pragmatic Shoppers Who Want It Fast and Easy

December shoppers may be fewer in number, but they’re mighty in intent. With 13% of adults (34 million) waiting until the final stretch, this group (skewing for Gen X and Boomer men) is driven by necessity and convenience. Most (75%) will shop between early and mid-December, while 25% will wait until the final week before Christmas. Over 4 in 5 say they only shop when they really need something, and 90% prioritize getting products quickly.

These shoppers are increasingly turning to online options. 20% shopped mostly or only online for holidays last year, and 24% plan to do more online shopping this year. They’re 23% more likely than the average adult to be influenced to buy from online stores with broader product selections and 18% more likely to appreciate easy-to-use websites. In-store, they want backup plans: 84% say having alternatives in case of out-of-stock items is crucial.

How to get Last-Minute Gifters?

- Promote “last-minute lifesaver” gift guides with guaranteed delivery dates.

- Highlight product availability and alternatives to avoid disappointment.

- Optimize your website for ease of use.

- Use urgency-based messaging like “Last Chance!” and “Limited Stock” to drive conversions.

- Offer concierge-style customer service via chat or phone to help them find what they need fast.

This year’s holiday shopping landscape is a marketer’s dream: three distinct consumer segments, each with clear motivations and behaviors. Early birds are strategic and socially conscious, Black Friday shoppers are tech-savvy and experience-driven, and last-minute gifters are pragmatic and efficiency-focused. Together, they represent over 200 million potential customers, and each group is primed for activation.

From early October to late December, there’s a continuous opportunity. Start early with ethical storytelling, go bold with immersive Black Friday experiences, and finish strong with frictionless last-minute solutions. The Winter holidays aren’t just about gifts. They’re about timing, relevance, and connection. And with the right strategy, your brand can be part of every moment.

Sources: 2025 August Retail Trends Study (SP25 USA). Base: Total US Adults 18+.

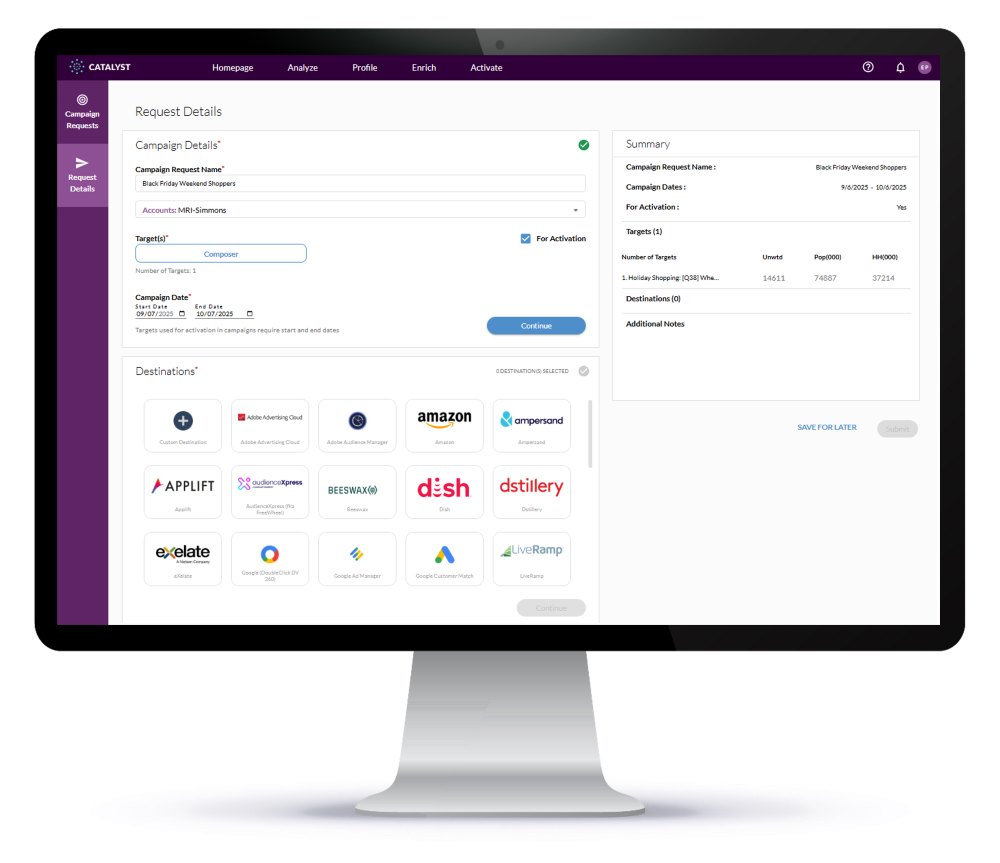

Activating Holiday Shoppers through MRI-Simmons

Through MRI-Simmons' activation solution, ACT, marketers can leverage trusted and nationally representative data to target and reach Early Birds, Black Friday Weekend Warriors, or Last-Minute Gifters. Curate your audience with over 60,000 consumer elements: 1000+ attitudes and opinions, 6500+ brands in 1000+ product categories; and 90+ proprietary segments. Then, activate your audience via the ad-tech platform or media partner of your choice.