How Americans Are Celebrating Halloween Despite Rising Prices

Inflation continues to shape the way Americans spend. According to MRI-Simmons’ Trending Topics Study, nearly half of US adults (47%) are cutting back on dining out, while 43% are actively hunting for deals through sales, coupons, and digital savings apps. More than a third are turning to dollar or discount stores and scaling back on clothing purchases. Brand loyalty is also taking a hit, with 35% of adults switching from name-brand products to generics. These shifts paint a clear picture: consumers are being cautious and cost-conscious.

But even in this climate of frugality, Halloween remains a bright spot. 75% of US adults, an estimated 196 million people, plan to do something to celebrate Halloween this year. That’s a powerful reminder that even when wallets tighten, traditions and festive joy still matter. For marketers, this presents a seasonal opportunity to connect with consumers who are still eager to engage, spend, and celebrate, albeit more thoughtfully.

Candy Reigns Supreme

Candy is the undisputed king of Halloween purchases. 50% of US adults (131 million people) plan to buy Halloween candy this year. Despite inflation, Americans are still reaching for their favorite treats, with Reese’s (25%), Kit Kat (19%), and Snickers (16%) topping the list of most-purchased brands in the past six months. Interestingly, Halloween candy buyers are also 6% more likely than the average adult to buy M&Ms, showing that brand affinity still plays a role in seasonal splurges. This continued investment in candy suggests that consumers are prioritizing small indulgences that bring joy without breaking the bank. For brands, this is a chance to lean into nostalgia, limited-edition packaging, and value bundles to capture attention. And with so many consumers planning to participate, even small shifts in messaging or promotions can yield big results.

Booze & Brews for the Holiday

Halloween isn’t just for kids. 19% of adults (50 million people) plan to buy alcohol for the occasion. Their top picks? Tito’s, Blue Moon, and Modelo Especial. What’s more, these Halloween alcohol buyers significantly over-index compared to the average adult for brands like Blue Moon (Index: 129), White Claw (124), and Modelo Especial (122), suggesting a preference for festive, flavorful, and social-friendly beverages.

This trend is even more pronounced among people planning to host a Halloween party (13%), who are 92% more likely than the average adult to purchase alcohol for Halloween. With over half of Halloween party hosts being Millennials (and parents of kids under 18 being 54% more likely to host) there’s a clear opportunity to target family-friendly gatherings and adult-themed celebrations alike. Alcohol brands can win big by aligning Halloween party culture through seasonal packaging, themed cocktails, and influencer partnerships. And since these party hosts are often influencers within their social circles, the ripple effect of a well-placed campaign can be significant.

Streaming Screams

One third of US adults, about 87 million people, plan to celebrate Halloween by watching scary movies, and streaming platforms are their haunted houses of choice. Netflix leads the pack with 65% of these viewers tuning in, followed by Prime Video at 48%. But what’s even more telling is how Halloween movie watchers over-index for subscribing to Disney+ (114), HBO Max (111), and Hulu (110) compared to the average adult. This suggests that Halloween fans are not just casual streamers, but they’re deeply engaged, multi-platform viewers. For media planners, this is a prime opportunity to align horror-themed content, ads, and sponsorships with the platforms where these viewers are most active. Whether it’s a spooky snack brand sponsoring a horror movie marathon or a costume retailer running pre-roll ads, the alignment between content and commerce is ripe for activation. These consumers are already in the mood to be entertained (and potentially influenced).

Gen Z Keeps the Tradition Alive

While only 17% of adults plan to go trick-or-treating this year, a slight dip from 20% last year, Gen Z is keeping the tradition alive. In fact, they’re 55% more likely than the average adult to plan to participate in trick-or-treating. And those who do go door-to-door are 120% more likely to purchase a Halloween costume, making them a high-value segment for retailers. This group represents a blend of nostalgia and novelty. They’re embracing classic Halloween traditions while also bringing their own flair. Think TikTok-inspired costumes, themed group outfits, and DIY creativity. Brands that tap into Gen Z’s love of self-expression and social sharing can turn Halloween into a viral moment. Whether through influencer partnerships, AR costume try-ons, or limited-edition drops, there’s plenty of room to innovate.

Why Halloween Celebrators Are a Prime Target for Activation

Despite inflation and cautious spending, the 75% of US adults planning to celebrate Halloween represent a resilient and engaged consumer base. They’re still buying candy, streaming content, hosting parties, and dressing up, just with a sharper eye on value and experience. These consumers are not just participating in Halloween; they’re curating it. For marketers, this means Halloween is more than a seasonal blip. It’s a strategic moment to connect with consumers who are actively seeking joy, tradition, and community. Whether through digital campaigns, retail promotions, or experiential activations, brands that show up in meaningful, relevant ways can earn loyalty that lasts well through the holiday season and beyond.

Sources: 2025 Q3 Trending Topics Study (SP25 USA). Base: Total adults 18+.

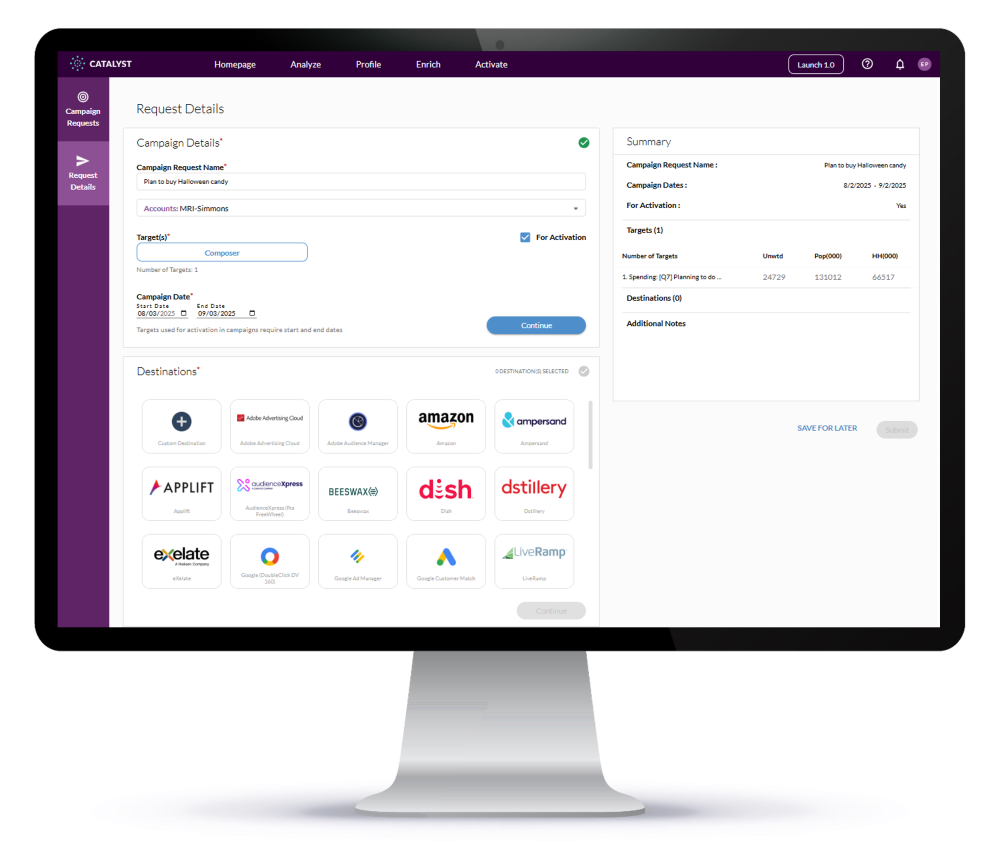

Activating Halloween Celebrators through MRI-Simmons

Through MRI-Simmons' activation solution, ACT, marketers can leverage trusted and nationally representative data to target and reach Halloween candy buyers, party hosts, scary movie viewers, and more. Curate your audience with over 60,000 consumer elements: 1000+ attitudes and opinions, 6500+ brands in 1000+ product categories; and 90+ proprietary segments. Then, activate your audience via the ad-tech platform or media partner of your choice.